How Atlanta Hard Money Lenders can Save You Time, Stress, and Money.

Wiki Article

The Main Principles Of Atlanta Hard Money Lenders

Table of ContentsThe 10-Second Trick For Atlanta Hard Money Lenders10 Simple Techniques For Atlanta Hard Money Lenders10 Easy Facts About Atlanta Hard Money Lenders DescribedExcitement About Atlanta Hard Money LendersWhat Does Atlanta Hard Money Lenders Mean?The Best Strategy To Use For Atlanta Hard Money Lenders

Oftentimes the authorization for the hard money lending can occur in simply eventually. The difficult cash loan provider is going to take into consideration the residential property, the amount of deposit or equity the customer will have in the residential property, the customer's experience (if suitable), the leave approach for the property and ensure the borrower has some cash books in order to make the month-to-month lending settlements.Genuine estate financiers that have not formerly used difficult money will be astonished at exactly how rapidly difficult money finances are moneyed contrasted to banks. Compare that with 30+ days it considers a financial institution to fund. This quick funding has actually conserved many investor that have actually remained in escrow only to have their initial lender pull out or just not deliver.

Their checklist of requirements boosts each year as well as most of them seem arbitrary. Financial institutions also have a listing of concerns that will certainly elevate a warning and stop them from also considering providing to a borrower such as current repossessions, brief sales, financing modifications, and also insolvencies. Bad credit scores is one more element that will certainly protect against a financial institution from providing to a borrower.

Atlanta Hard Money Lenders - An Overview

The good news is genuine estate investors who might presently have a few of these issues on their record, tough money lending institutions are still able to lend to them. The difficult money lending institutions can provide to debtors with issues as long as the consumer has sufficient deposit or equity (a minimum of 25-30%) in the property.In the instance of a potential borrower that wants to acquire a primary house with an owner-occupied hard money financing through a private home loan lending institution, the customer can originally purchase a residential property with difficult cash and then work to fix any kind of problems or wait the essential quantity of time to clear the problems.

Financial institutions are also unwilling to give mortgage to consumers who are freelance or currently lack the needed 2 years of employment background at their present setting. The customers might be an ideal candidate for the funding in every various other aspect, however these approximate demands protect against financial institutions from expanding financing to the customers.

About Atlanta Hard Money Lenders

In the instance of the customer without enough work background, they would certainly be able to refinance out of the hard money financing as well as into a lower cost traditional finance once they obtained the needed 2 years at their current placement. Hard cash lenders supply several loans that conventional lending institutions such as banks have no passion in funding.

:max_bytes(150000):strip_icc()/GettyImages-1137516784-604537c07dad40eea021db81f5527ecf.jpg)

These jobs involve a genuine estate investor buying a building with a short-term car loan to make sure that the financier can swiftly make the required repair work and updates and after that offer the home. atlanta hard money lenders. For the most part, the real estate capitalist only requires a 12 month loan. Banks desire to offer money for the long-term and more than happy to make a small amount of interest over an extended period of time.

The problems could be connected to foundation, electrical or plumbing and also can trigger the bank to take into consideration the residential property unliveable and unable to be funded. read the full info here as well as are incapable to consider a funding circumstance that is outside of their strict lending standards. A hard cash lending institution would be able to give a borrower with a finance to purchase a residential or commercial property that has issues preventing it from receiving a conventional bank finance.

The Best Strategy To Use For Atlanta Hard Money Lenders

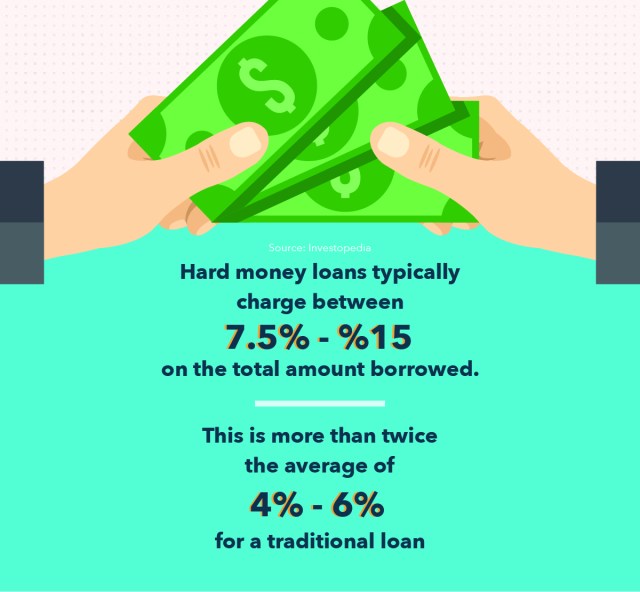

Hard money lending institutions also bill a loan origination fee which are called points, a percentage of the funding amount. atlanta hard money lenders. Factors typically range from 2-4 although there are lenders who will bill much higher factors for certain situations. Certain locations of the country have several contending difficult cash loan providers while various other areas have few.

In big urban areas there are generally lots of more hard cash lenders ready to provide than in farther backwoods. Borrowers can profit considerably from checking prices at a few various lenders prior to committing to a difficult money lending institution. While not all tough cash lending institutions provide 2nd mortgages or trust fund acts on buildings, the ones who do charge a higher interest rate on 2nds than on 1sts.

Atlanta Hard Money Lenders Can Be Fun For Anyone

This raised rate of interest rate shows the increased risk for the loan provider remaining in second setting as opposed to 1st. If the debtor goes into default, the first lien holder can confiscate on the residential property as well as eliminate the 2nd lien owner's interest in the home. Longer regards to 3-5 years are offered yet that is generally the top restriction for financing term size.If rates of interest go down, the consumer has the choice of re-financing to the reduced existing prices. If the rates of interest boost, the consumer has the ability to keep their lower rate of interest loan and also lender is forced to wait till the financing becomes due. While the loan he has a good point provider is awaiting the lending to end up being due, their investment in the count on action is generating less than what they could receive for a new depend on deed financial investment at current rates.

The Ultimate Guide To Atlanta Hard Money Lenders

This is a worst situation scenario for the tough money lender. In a comparable circumstance where the borrower puts in a 30% deposit (as opposed to just 5%), article source a 10% decrease in the worth of the building still provides the borrower a lot of reward to stick to the home as well as task to protect their equity.Report this wiki page